"Working on your own doesn't come with a fixed monthly income"

Manage your expenses simply and responsibly.

Plan for your safety net and have control over your money.

Create my account

Hi, I’m Zsolt and I’m happy to share this app with you!

I’m working as a freelancer in IT for more than 10 years. Working like this, you don’t have a fixed monthly income. And I really wanted to be relaxed and to offer my family stability when it comes to our money.

That's why I started looking for tools to help me manage our money as wisely as possible. But unfortunately, I didn’t find the available apps on the market as easy to use and focused on the future, as I wanted. So I decided to build my own, which is how the Expense Guide App was born.

And because I know there are a lot of people like me out there, focused on efficiency and wanting financial safety, I chose to share this app with the rest of the world. Try it out, it might be exactly what you're looking for as well!

How can this app help you

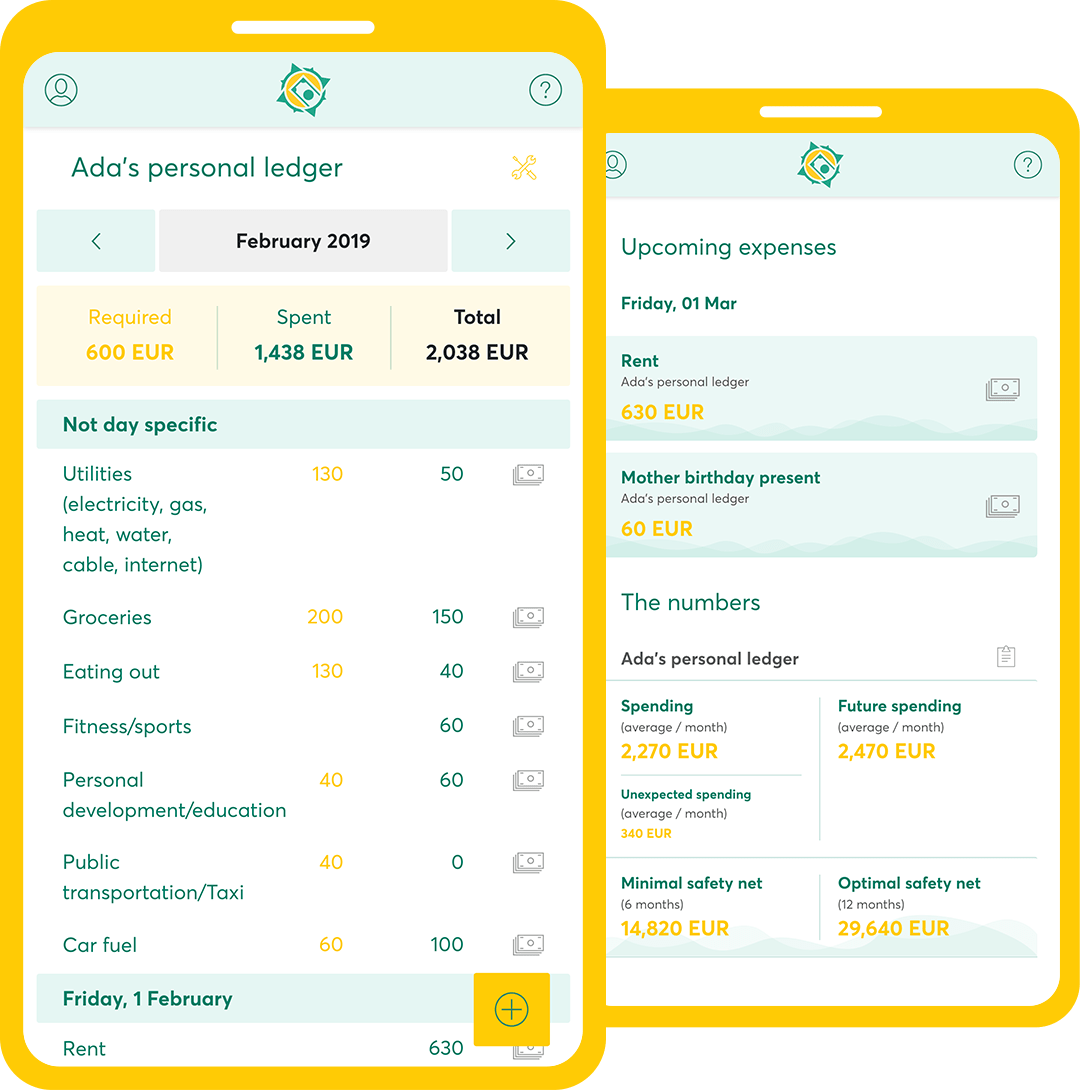

Focused on simplicity and easy to use, Expense Guide helps you to:

Track your daily spendings.

It runs on mobile as well, so you can add an expense right away.

Plan recurring or future expenses in advance.

Make financial estimates without you worrying about doing any math for that.

Build your safety net for 6 or 12 months.

And you can do this in as many areas as you want.

For example, you can plan and track personal money, your business money or for a special project you want to track separately.

This is not a complicated app that you stop using the next day

No fancy graphs, no predefined categories or irrelevant details!

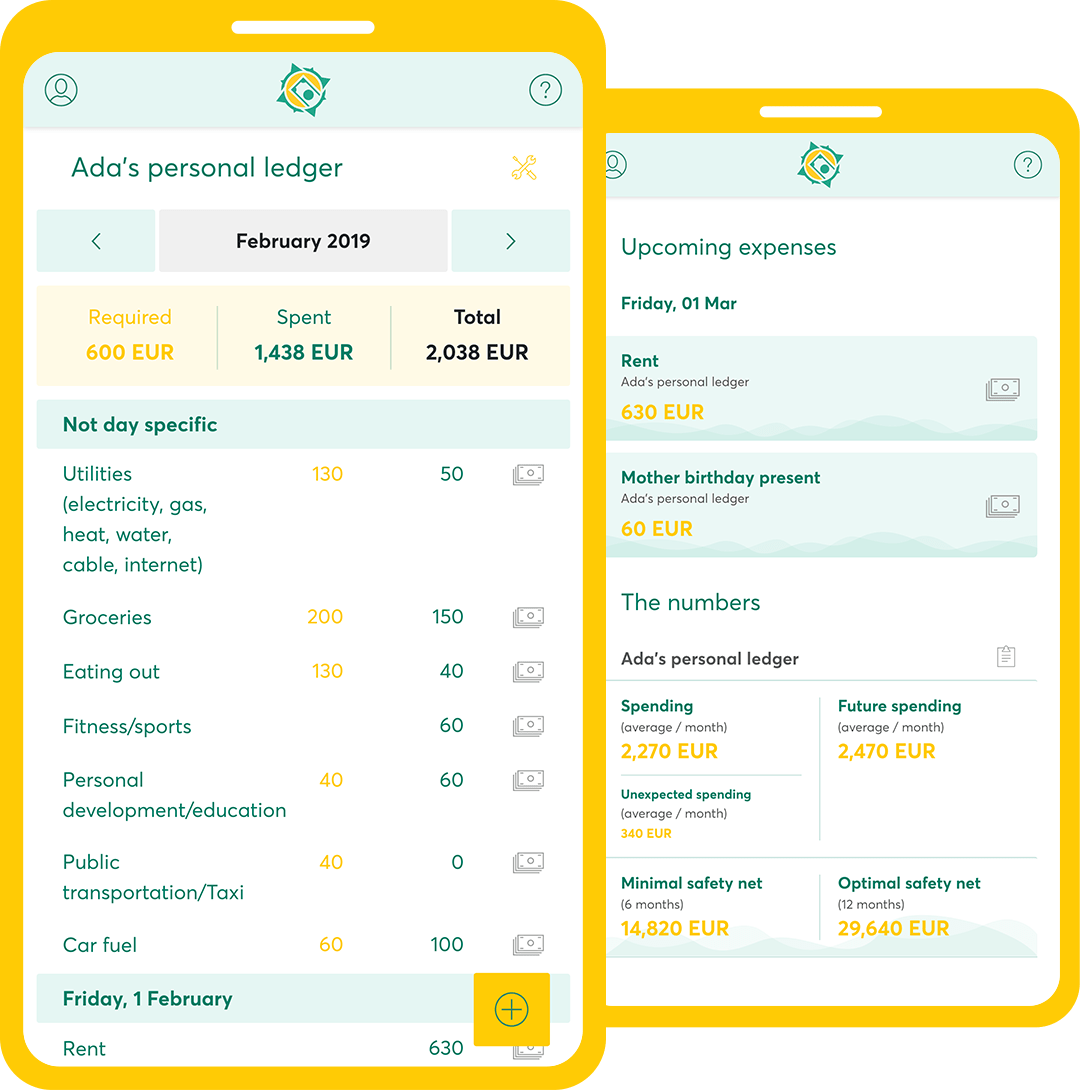

Just a simple list of current and upcoming expenses, and 5 numbers of great importance:

Average monthly

spending

Average monthly

unexpected spending

Average future

monthly spending

Minimal safety net amount

(for 6 months)

Optimal safety net amount

(for 12 months)

Why is Expense Guide different?

... and therefore more friendly and easy to use

-

Oriented on the future, it offers you a real projection of how much money you really need in order to mantain your current lifestyle, while saving for your safety net. More accurate if you use it for at least 1 year.

-

Because an expense is seen as an estimate + a payment, it helps you learn how to better estimate your future expenses.

-

You can estimate expenses without setting a specific date, because it might be hard to know the exact date for most of your expenses.

Other cool features of Expense Guide

NO income data required — besides being too personal, it would also imply for you to be truly diligent with tracking everything, in order to make sure the 'available funds' amount is kept accurate at all times… and I want to make your life easier with this app, not stress you out!

NO decimal numbers — I believe that a personal finance app will never reflect 100% a person's spendings down by every penny, so it’s safe to assume that we could simply enter a $15 amount (round up) for a $14.20 purchase.

NO credit card transactions processed

NO reminder emails — at least not for now. The feature will only appear if users will ask for it.

Is it for you?

Expense Guide is suitable for everyone, regardless if you have a fluctuating stream of income or a fixed & very predictable one.

But if you do have an unpredictable income, maybe this is the perfect app for you.

Contact

Want to report an issue or suggest a feature enhancement?

Or do you simply wanna say "hi"?

I'm one e-mail away — support@expense.guide